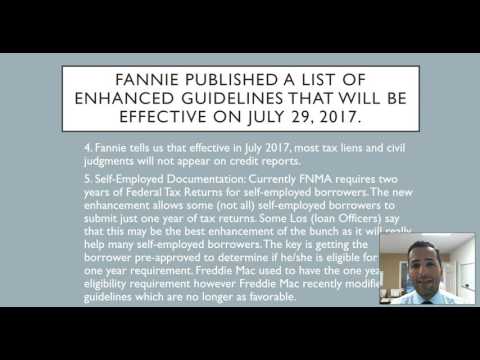

Hi guys, good afternoon. My name is Andres Morales. I'm a local real estate broker with Bonaventure Realtors here in California. I'm also licensed in the state of Florida and the state of Washington. I received an email from a local loan officer who sent me some really good information about upcoming changes happening on July 29, 2017. Some of the changes that Fannie Mae is going to enhance or change within their underwriting guidelines are the debt to income ratio, disputed accounts, self-employment documentation, the student loan cash out refinance, arm loan to value increases, and the treatment of time shares on credit reports. Starting on July 29th, the current maximum debt to income ratio, which is 45%, will be increased to a new maximum of 50%. The debt to income ratio is calculated by dividing the debt by the income in order to determine a percentage that is used to qualify for a loan. Currently, if your debt to income ratio is higher than 45%, you may qualify for an exception depending on the circumstances. However, with the new enhancement, you can go up to 50% of your income to qualify for a new home purchase. This will significantly increase the number of buyers in the market and create more demand for the current supply. The second change is regarding disputed accounts. In the past, borrowers would dispute any derogatory credit items on their credit report, and the bureaus would remove the items while they were being investigated. This created a small window for some borrowers to slip in and get approved for a loan. Fannie Mae and Freddie Mac closed this loophole and now will evaluate loan files with credit disputes. In some cases, they may require further action to resolve the disputes. I hope you understood the message. Before,...

Award-winning PDF software

Fannie mae gift guidelines 2010-2025 Form: What You Should Know

The borrower would be required, if requested, to repurchase the loan if Fannie Mae subsequently Sell Guide — Fannie Mae Sep 26, 2025 — B3-5-17, Lender Record Information (Form 4) (07/01/2017). . . . . . . . . 181 B3-5-06, Fannie Mae Disclosures (06/28/2018) Fannie Mae's New Mortgage Services Policy (SNMP) states that for a purchase transaction, a lender is required to accept payment of the purchase price using a single payment. The lender has the option of using all, some, or none of the purchased security. This payment method provides an additional safety net for borrowers whose payments are not sufficient to cover the remaining principal balance. There are several ways to select each payment method. . . . . . . 181 B3-5-00-002 (07/01/2017). B4-1-01, Mortgage Services Requirements (05/25/2016). Selling Guide — Fannie Mae May 18, 2025 — G4-1-001, Payment Method (05/25/2016). A4-2-04, Lender Record Information (Form 582) (01/31/2017). B3-5-06, Fannie Mae Disclosures (06/28/2018) Selling Guide — Fannie Mae Dec 13, 2025 — Lending Guidelines for Subprime Mortgages (05/29/2018). B5-5-10, Loan Considerations for Disqualified Lenders (07/01/2018). A4-2-03, Lender Record Information (Form 582) (01/31/2017). B3-5-00-003, Payment Method (05/25/2016). . . . . . . . . 181 B3-5-02, Borrower Information (07/04/2018).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Calyx Gift Letter, steer clear of blunders along with furnish it in a timely manner:

How to complete any Calyx Gift Letter online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Calyx Gift Letter by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Calyx Gift Letter from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fannie mae gift guidelines 2010-2025